So, without further ado, here are my themes:

1. Open is the New Black

There are several historical, societal, technological and political memes that have converged recently to really push the idea of open. Open as in transparent, responsive and truthful. These ideas have a long history dating back to the Renaissance, the American and French revolutions, through to modern mass communication, literacy and egalitarianism to open systems, personal PCs, the Internet and open source, to finally end up with revolutions in Tunisia and Egypt – and the demand of consumers for more transparency in environmental impacts. Through this is a critical thread:

Open wins in the end

Business, governments and organizations that don’t embrace the ideas of transparency, openness and truth will, in the end, loose. Those that do will emerge winners. I would note that this is a long term trend. It’s taken Western societies 400+ years to get to this point and most companies/organizations are not even close to this yet.

2. The Future is Distributed

Right now, we are seeing a great concentration of information, computing power and control in a very small number of companies that are building ever larger data farms. We’ve been here before, several times. The most obvious parallel is the mainframe computer (and the estimates that only a few would meet all future computing requirements) and broadcast television. Both have been disrupted by the introduction of systems that pushed capabilities into the hands of endusers, the PC and YouTube. The whole ‘cloud’ trend that permeates current tech circles is not really ‘cloud’ at all since most of the underlying systems are concentrated in datacenters. The key trends I see disrupting this are ubiquitous bandwidth, portable renewable power, high-performance mobile computing. In then end, the traditional datacenter will probably fade away and:

Distributed computing will be the new cloud

Companies that are focused on delivering ‘cloud’ anything without actually detaching themselves from the datacenter will experience problems in the next 5-10 years. The winners will be those that discover and exploit technologies which enable this distribution.

3. Art as innovation

Steve Blank recently said that entrepreneurs are artists, something which I largely agree with but would take one step further. If innovation is about challenging and disrupting existing technology and business paradigms, then the equivalent in the social, cultural and political sphere is artists. In fact, Renaissance rulers understood this very well and were huge patrons of artists, even ones challenging their historical legacy. There is an important lesson here, one which is largely lost in the sterile tech world (and even more so in large businesses). Innovation does not usually come from people with a string of degrees in white coats, it usually comes from the rebels, the people who refuse to follow the status quo, the artists – or, as my wife referrers to them: “the people with the blue hair”. A fundamental precept here is that:

Innovation comes from those that are swimming against the status quo

There are probably quite a lot of missed opportunities, both at the venture and enterprise level, because people propose things that don’t fit into the generally accepted worldview. Seeking out those radical thoughts is more likely to yield results, particularly when society’s speed is accelerating. Surprisingly, Silicon Valley is particularly bad at cultivating truly radical thinking, quite a few people believe that all the diversity they need can be found in their “Stanford network”. However, Harvard discovered this was a fallacy when they published their top 50 CEO list and only 14 had MBAs…

4. Market of One

This is something I’ve believed in for quite some time. It’s the idea that we are moving to a world where mass customization is not just possible, it’s also the default. This already happens when you order certain items online (iPhone, custom Nikes, etc), but I think it’s an accelerating trend. Not only that, but the technology that makes this possible is getting ever cheaper, leading to a multiplicity of producers. The side effect of this is a vastly more distributed manufacturing base and a lot more emphasis niches. It’s the long tail played out in physical goods. This trend is already in full swing and has really come to the fore in the 6 years since I first started talking about it. Websites like Etsy and ShapeWays, not to mention the whole MakerBot phenomen are expressions of this. But it’s also impacting much larger systems – I know one guy who machines F15 parts in his garage, something he can do as sophisticated machinery is now the price of a car instead of the price of two houses. In some ways it harkens back to my second theme – The Future is Distributed -but it has one major point:

Mass customization will move production closer to the customer

Sure, we’ll still have a lot of heavily mass produced, generic stuff, but people also want personal things that reflect them, things that have stories and histories they can relate to. And there are a whole new generation of technologies which are enabling this.

Of course, these are all my random musings, but they’ve been guiding some early-stage investments I’ve made in the recent past and some of the work I’m doing with non-profits.

]]>

Mail, calendaring, document sharing

Hands down, Google Apps for Domains wins. Yes, it’s the evil empire, but your other choices are unfortunately crappy or lots of work. I use it in conjunction with Thunderbird and Lighting (right mouse click, Convert to: Event – that rules!), so I rarely ever login other than to work on docs or upload stuff. Also, easy to sync to mobile devices – which is key.

On very, VERY important side-effect of Google Apps for Domain is the incredible variety of marketplace apps. And that ecosystem has one feature that rules them all – single signon. Yeah, I know, there are three of you and you don’t need it – but when you grow, you WILL need it.

For this to work properly, it’s best to signup for apps through the Google marketplace – thus making you even MORE beholden to them.

Sales tracking, CRM and invoicing

For sales tracking and CRM, I use CapsuleCRM. There are others, like Pipeline Deals, Highrise and others which are equally competent, just pick one that works for you.

For simple invoicing, FreshBooks rocks. It’s even useful as a minor expense tracking tool. If you need to do more complex invoicing, or for a lot of customers, take a look at Chikpea.

Hosting, CMS

I have this blog and my company website hosted at ServInt, both are running on WordPress, which I highly recommend for relatively static sites with few editors. If you need more capabilities, I would look at Cloud Access’s hosted Joomla service. Both WordPress and Joomla are great as they have tons of plugins and large communities, making it relatively easy to build complex sites quickly. However, be aware that future upgrades may not be smooth if you find some of the plugins you use have been abandoned by their authors….

Of course, neither of these necessarily have everything you need to develop a web-based offering, but they do really well in semi-static sites that are usually put up while developing something else. I use CloudFlare to protect my sites (along with mod_security and some other things). They also provide an interesting checkpoint to Google Analytics or other metrics packages.

If you have extended hosting needs, I’ve used the same hosting company, Voxel.net, for my last 3 companies and would use them again in a heartbeat. They’ve recently developed a hybrid managed hosting + on-demand cloud scaling which would work well for a lot of startups. I’ve also used Softlayer successfully, but watch out for their extremely aggressive policies if you miss a payment. I had a card expire while traveling and a site was down for 2 days as a result. Not good.

Yes, I know, you could use EC2 or some other cloud service – but, realistically, most sites will not have enough traffic on the corporate brochure-ware site to justify the overhead of using such services. And, yes, it shold probably be separate from your main app if you are web based.

Accounting

In the past I’ve used Outright, but I switched to Xero as they have a more complete solution. I generally dislike Quickbooks, but that seems to be everyone’s default. For expenses, I have a PayPal card and I write expense details on every receipt.

Some people swear by Expensify, but I seem to keep track of expenses just fine without resorting to it.

Analytics

Besides Google Analytics, I’ve used ClickTale, which is very useful in understanding what people are looking for on a particular page. This led us to reduce the Concept32 site to just one page instead of having a lot of content no one was actually interested in.

Collaboration

A tough nut to crack. I’ve tried a number of tools, but none seem to actually pull people in. I really like TeamBox, but others like Basecamp better. This is really dependent on how people work and how much structure/process is needed. I would point out that I’ve recently had to manage some much larger projects, and OpenProj has been really helpful. I’m also exploring using Smartsheet to make these planning docs more widely available.

Misc other stuff

As everyone else, I have a pile of tools I rely on all the time. Like Prezi (quick, good looking presos), TweetDeck (social media tracking), Toktumi (virtual PBX), eFax (duh). Backups are also critical. I use Crashplan, which is multi-platform (Win, Mac, Linux, Solaris) unlike a lot of solutions. They are also in Minnesota and cashflow positive with no venture funding, both of which are great stability indicators. Some others use BackBlaze with success, but they are in the same geo as me, something I’d rather avoid.

All the other things…

Of course, this does nothing to address wider issues around building a startup, particularly scaling systems, process, delivery methods, etc. But the point is to first implement a usable and relatively scalable base infrastructure – something you will not need to worry about for some time.

]]>http://www.web3mantra.com/2011/03/04/50-free-wordpress-themes/

http://www.smashingmagazine.com/2010/08/19/100-free-high-quality-wordpress-themes-for-2010/

http://victorsosea.com/75-best-free-wordpress-themes-ever/

http://smashinghub.com/15-free-clean-minimalist-wordpress-themes.htm

http://www.wpmods.com/50-free-minimalist-wordpress-themes

http://www.bloggingtechnews.com/wordpress/themes/free-minimalist-wordpress-themes/

(yes, I was looking for a minimalist theme)

The upshot of this is that my website will be variable and possibly broken in the next few hours…

[update] stopped my trials with the Titan theme (link in footer) – going outside as it’s gorgeous out and there’s a concert in the park…

]]>BlackDuck – http://www.blackducksoftware.com

Chikpea – http://www.chikpea.com

Equalis – http://www.equalis.com

Earthster – http://www.earthster.org

And finally, my own company:

Concept32 – http://www.concept32.com

]]>Apologies for the late New Years email, I returned from a month without internet access just last week and dove into 2500 unread emails, along with countless other backlogged items.

I wanted to wish you all a great 2011 and send out a short update. For me, 2011 started off with a bang with the sale of Olliance to BlackDuck. I was also privileged to participate in a number of interesting startups in 2010, including Chikpea, Earthster, Equalis and a few others I can’t mention. The last two quarters of 2010 saw a large upswing in activity on all fronts, and this looks set to continue into 2011.

For 2011, I’m continuing to mentor, focus, support and advise companies & non-profits, from startup to global 1000, all while looking for that next ‘big idea’…. As you might imagine given my broad interests, I’m casting a pretty wide net, from light manufacturing, to sustainability to computing technology.

I’ll also be attempting to spend more time nurturing neglected personal and professional relationships, something I’ve never been particularly good at. In that vein: Don’t be a stranger! Please feel free to contact me anytime, by whatever medium works best for you.

Wishing you and your family a prosperous 2011,

Chris Maresca

P.S. You received this email because you are a business or personal acquaintance of mine.

Aside from the fact that every other session was either about mobile (re. content on iPhones) or about how to monetize content on iPads, there wasn’t all that much new being discussed. However, most of the executives I met were very sanguine about web content and the problems they have with existing and back catalog content.

One clear problem emerged around publishing web content – negotiating reasonable terms with rights holders. I heard several VP-level and above execs express huge amounts of frustration with rights holders and their demands. One had even recently quit because of his inability to get reasonable terms and several others were looking for a way to get out of the business.

At this point, I’d like to explain how TV shows and movies actually work. Basically, you can think of a movie or TV show (a ‘property’ in Hollywood-speak) as a collection of performances by a bunch of ‘artists’, choreographed by a ‘producer’. Each ‘artist’ (it could be a company as well) retains the right to their performance and are referred to as ‘rights holders’. And it’s the ownership of these ‘rights’ in particular ‘properties’ that allow ‘artists’ to be paid every time something is shown (this is know as ‘residuals’ in the industry). In most cases, ‘rights’ for a ‘property’ are negotiated when it is initially made, usually around ‘platform’ rights (e.g. a platform being movie, cable, tv, tape, dvd, airplanes, pay-per-vue, commercial use, etc) and geographic rights. However, when a new ‘platform’ emerges (web, internet streaming, downloads, blueray etc), rights must be negotiated for that new platform for each property.

So, back to our story. The (very) senior executives I was talking to were all facing the same rights problem. They would like to publish existing and back catalog content on the web, but the complicated matrix of people and organizations that owned rights in these properties made it impossible to get everyone to sign-off on web publication.

Apparently, some rights holders are demanding large upfront payments in exchange for signing off on web publishing the content. And, because the revenue models are uncertain, no body is willing to risk large amounts of money upfront….

The irony of this, of course, is that consumers will download the content anyway, further and further reducing it’s value. Even worse, the unwillingness of current rights holders to license content for web publication is undermining the future of the residuals system since it is pushing content producers towards ‘work for hire’ royalty free content.

In the end, the reason why your favorite show is not available online legally is probably because, someone, somewhere is being selfish and greedy. And that is adding up to a problem no one is seemingly able to solve.

]]>In business, it’s critical to have ways of cataloging progress and give a historical perspective of what is going on. Sure, revenue is a useful reference point, but it says nothing about how the money was made – or how it could be made more effectively. Ideally, this would be rolled up into a financial model which used historical numbers to project forward. But even without this level of detail, it is still possible to derive useful information from even the simplest numbers.

After my phone discussions with the CEO, I clearly understood that the business was not doing whatever it took to generate business, and that my emphasis was going to be on more face-to-face networking and pitching to local companies.

So, there I was, standing at the whiteboard, ready to point out that their lack of revenue was due to not enough in person sales. But, as the CEO and VP of Sales went over what metrics they had about conversion rates, I suddenly realized that I was wrong. The numbers told the story – and the story was that there was no way that they could get the revenue numbers they needed without a radical change in the business. It was a relatively simple, but radical solution – to stop going after individual customers and instead focus on channel partner recruitment.

For this company, it was a revelation that their sales strategy was doomed to failure, and, for me, it was yet another lesson in listening to the numbers, even the few you might have.

]]>Nothing is a substitute for doing the hard work of face to face networking, but LinkedIn is hugely helpful in keeping up those relationships, particularly as people transition from one job to another. It’s also extremely helpful in surfacing people in other industries and helping to setup face to face meetings in other regions you may be traveling to.

Ultimately, however, it’s like everything else, you get out of it what you put into it. Social media (e.g. Twitter, Facebook and LinkedIn) is particularly weird in the sense that it might take quite some effort (and time) to get out of what it promises.

It’s also important to remember that in some geographies like Silicon Valley, it’s pretty much a requirement to be on LinkedIn – in other places or verticals other than tech, it’s not as common or it may be another social media network. In Europe, Bebo and Xing are much more used that LinkedIn – and Facebook is increasingly what people use to connect for business purposes.

As far as generating business from LinkedIn, it’s pretty clear that no single medium ‘generates business’, you have to work a broad front and each little bit increases your ability to ‘generate business’.

In the end, there is no magic bullet, it just comes down to hard, consistent work over a period of time, much like every other aspect of business. In that sense, social media is no different.

]]>Congratulations all around.

Link: http://dev.wavemaker.com/blog/2010/01/06/wavemaker-rides-the-cloud-computing-tsunami/

]]>One thing that’s very much missing in most entrepreneur’s understanding of the fundraising process is the notion of total addressable market (TAM) and it’s relationship to fund size. Basically, it’s the understanding that fund size vs number of partners drives the available investment size.

An overview of how this works

Since partners can only typically manage at most 10 companies simultaneously, 2 partners at a $100million fund will invest in a maximum of 20 companies. Usually, the first five years of a fund are devoted to new investment, and the last five to supporting existing portfolio companies. Money is usually allocated 50/50 to new vs support, so this hypothetical fund would have about $50m to invest in 20 companies. $50m divided by 20 gives you roughly what the investment amount would be about $2.5m.

The flip side of this are rough calculations about TAM and exits. If the TAM of a company is $100 million and you assume they can capture 10% of the market in 10 years, then their revenue will be around $10m, with a valuation of somewhere between 3x to 15x revenue depending on the vertical. At the lower end of that, it would be a company worth $30m if everything works out.

Going back to fund size, if the fund is targeting a 10x return, then investing $2.5m in a company that might be worth $30m at exit is just about right, assuming no other dilution. Of course, this leaves out a lot of details and is uber-simplistic, but I can guarantee that every VC you talk to is doing these sorts of rough calculations in their head.

However, what’s really important about all of this is understand your company’s TAM and doing your homework about size and lifecycle of funds investing in your vertical. If your TAM is $100m and you approach NEA ($2b raised for their latest fund), then you will likely never get funding. A lot of entrepreneurs don’t seem to be willing to do the legwork in researching investors/funds/etc, but that’s one of the keys to success. I would add that the VC tool of choice for doing research is VentureSource – yes, it’s not cheap, but if you are looking for funding, it’s a goldmine of information on valuation and fund status

This is a very common mistake made by a lot of entrepreneurs, even experienced ones. I’ve given a presentation at a bunch of conferences about this very topic and it’s always shocking how many people don’t understand these dynamics.

]]>The most interesting statistic, however, was one that was generated specifically for this particular meeting and is not part of the regular dataset. It was statistics about company growth in Silicon Valley, and it revealed the lack of companies growing to significant size. For me, it just reinforced my gut feeling that the VC model was broken and that the real target should be lower exits, not monster hits.

First some definitions, in BLS terms:

- Small company – less than 50 employees

- Medium company – 50 to 250 employees

- Large company – 250+ employees

I would note that the BLS looks at payroll to determine employees, so contractors don’t count.

The BLS had put together data about companies growing from small to medium to large over the 8 year period from 2000-2008, it was summarized in the following table:

[table id=1 /]

What’s surprising about this is that only 8 companies became ‘large companies’ in 8 years. That’s one a year, and if you think of company size as a proxy for revenue, then it’s pretty stunning.

P.S. Sorry for the crappy table, turns out tables in WP are a huge pain in the ass…. The vertical numbers represent the state of affairs in 2000, whereas the horizontal numbers represent the state in 2008, so reading from left to right gives you the changes from 2000 to 2008…

]]>What I look for in a pitch

A pitch is several stories. It’s the story about how you will successfully run your company if you get money and it’s much like a sales pitch. But it’s not just your company’s story, it is also the story of you and the people on your team, the industry you are targeting, the story of your customers and finally, the ending chapter of your company. Like every good story, these should have arcs that meet at some logic point. And, like most good stories, it needs to be cogent, logical and progress along path. All that said, what are the tangibles that I would look for in a pitch? Well, here are some:

- Entrepreneurs should know everything about their business/market and I consider it a bad sign if I know even just a little more

- Know who I am, why you are talking to me and what your expectations are from me

- Have done their homework about investors, funds and criteria.

- Polished presentations & financials

- Business plans in the traditional sense are a waste of everyone’s time – I don’t really care if you have one

- A good, clear slide deck that lays out the future of the company (the story, see above)

- Detailed financials that are in sync with the deck

- Polished, articulate delivery of both the deck and financials (you need to know this stuff cold)

- A clear understanding of real and potential competitors, with a view of competitive differentiators

- A clear and complete executive summary that someone can grok in less than 10 min.

- A good website

- Finally, there should be some sort of working prototype or demo, esp. if it’s software.

There are tons of online and offline resources for learning how to do all of this and there really is no excuse for not doing it. I would also point out that I don’t expect everything to be in the deck, just a good, compelling story about the future of your business, industry and customers. That said, I expect you or your team to be able to answer every question I ask, in detail if appropriate. And if you don’t know, don’t make it up.

So there it is, a basic outline of what should be in the pitch. I would point out that there is a lot of other detail about what should be in there and that you should understand what your target investors are looking for when putting together your pitch.

]]>So, I set out to find a fully managed server, preferably provisioned as a virtual server since that would probably give me better backup. There are a lot of routes to this, including cloud services. It turns out that cloud services are actually substantially more expensive that what I pay for a dedicated box and few offer fully managed systems even at that high cost. So I was basically left with traditional virtual private server (VPS) offerings. In this space, there are basically two models – Xen or Virtuozzo, aka. OpenVZ (at least on Linux…). Xen has the advantage of providing dedicated resources (memory/CPU) to the VPS, where as Virtuozzo has guarantees and bursting, sort of like cooperative multi-tasking. Generally what this means is that Xen has fewer VPSs on a single server than Virtuozzo as there is no possibility to share resources between VPSs. In practice, it also means that Xen VPS hosting is also quite a bit more expensive than Virtuozzo.

So, with that in mind, I set off to find some hosting providers. There are a LOT of hosting providers, and the real difficulty is identifying those which have relatively good performance, service quality, price and features. Here are the ones I seriously considered:

- ServInt

- WiredTree

- KnownHost

- JaguarPC

- VPS.net

- NetSonic

- LiquidWeb

- SliceHost – Xen hosting, unmanaged

- MediaTemple

Most of these were extensively researched by reading forum posts (in WebHostingTalk and quite a few various other forums) about various providers. These providers consistently come up as recommended and, in the case of ServInt, WiredTree, KnownHosts, JaguarPC and LiquidWeb, actively participate in the discussions. It was also particularly instructive to see how hosting providers worked to resolve client problems. I also looked at how long a company had been around and what their finances might be like, and did some network tests to check connectivity. All this research was done over a span of about two months, with the final decision to be done before Xmas 2009. There are plenty of cheaper providers (these are about $50/mo for their cheapest offerings), but you get what you pay for and it’s hard to make decent margins at the cheapest prices.

Finally, I also considered EC2 using this image http://developer.amazonwebservices.com/connect/entry.jspa?externalID=2975&categoryID=204 but it’s unmanaged, so it was a non-starter.

I would note that if you are a business with any sort of traffic, while a VPS is fine (and should be considered a minimum), you really should have your own dedicated system, particularly if it contains sensitive client information. My recommendations are either Voxel.net – which I have used for 3 companies over the last 10 years (and I never once has a failure); and SoftLayer – which I have used for the last 3 years for my personal system. The absolute cheapest dedicated hosting I have seen is VolumeDrive, but I have never used them, so can’t really speak about it.

In the end, I would up on a VPS from ServInt (which is where you are reading this from…). They had the best ROI and features combination. The very close runner up was WiredTree. Really, you can’t go wrong with either, and I choose ServInt only because they offered Plesk’s Power Panel as a management UI, which, although I dislike most of these GUI tools, I like better than C-panel.

I’m almost done migrating sites from SoftLayer to ServInt and it’s been pretty easy. After that, I’ll have to deal with email migration (ugh).

]]>Sooo, I’m left re-considering my options. Suddenly, Google’s offerings seem quite attractive, esp. since they have a Blackberry OTA sync client that’s free. Hmmm. I might also have to have a second look at The Message Center as they offer a BES-independent BB sync of some sort.

What a pain. Really and truly. I need to make decision soon so I can migrate and stabilize all this before I go on extended travels…

]]>The organization in question was the US Travel and Tourism Administration (USTTA), a division of the US Dept. of Commerce that keeps track of statistics about tourism and generally tries to support the industry (which, BTW is either the first or second largest US export, depending on how it’s counted). I was working for a government contractor, Ellsworth Associates (which has since been sold several times over) and was the head webmaster, a huge deal in 1995.

My very first job was to build a web presence for USTTA, which we would up calling TInet (in the fashion of the day…). So I set about designing a look and feel that would work well.

Fast forward to 2010, almost 15 years, and, guess what, TInet looks almost exactly the same…. Check it out: http://tinet.ita.doc.gov/research/index.html

Fantastic, how retro. I guess my 15 year old design was hugely advanced for it’s time. Wonder if they are still using the e-commerce (shopping cart back then) code I wrote in Perl all those years ago….. Hopefully it still runs on Linux.

P.S. Apparently there is no more shopping cart and it’s now running on IIS. So much for progress.

]]>I looked at the following hosting companies:

- 01.com – website is garish, but it offers everything I wanted, although sales is NOT responsive

- mindcentric.com – ditto, but sales was very responsive

- specialai.com – lots of good recomendations, sales very responsive, no upfront pricing

- sonomacreative.com – I like supporting local SMBs, but they never got back to me about pricing

- datasync.com – Has an interesting suite integration with Sugar, but it’s overkill for me and the minimums are expensive

- themessagecenter.com – good price vs features, pushed all the right buttons, but this seems an Exchange centric shop trying to branch out, which is a risk for me

In the end, partially because of my wanting BES and ActiveSync plus a fair amount of storage and a large number of domain aliases, 01 and Mindcentric where the only two real contenders. Others offered a similar combo, but the ROI was not so good when adding up all the extras, like domain aliases or extra storage. I’m currently trying out a free account for one month at 01.com, we’ll see how it goes. At $50/year, it’s competitive with Google Apps, although with a lot less storage.

I really think that Zimbra should have a more detailed partner offering for hosting. Certainly their rankings help, but with so many providers to choose from, it would be good to have a community filter. Of course, that’s not really in their best interest. And, BTW, what happened to Yahoo offering hosted Zimbra? Seems like a natural fit….

I did briefly consider hosted Exchange, but then I remembered how hard it usually is for me to wrap my brain around Microsoft’s terminology and implementation logic. It sounded like a perfect recipe for chaos.

[note: I got a nice email from SpecialAI about my post and clarified some things as a result. It's good to see that at least one company is paying attention to what people are saying about it....]

]]>Or so I thought.

I couldn’t make the whole thing as it was an all day event and I had overlapping obligations. Instead, I did my best to catch bits and pieces of the stream and show up for the afternoon portion. Disappointing is an understatement. I’ve watched many great TED talks online, and only one of the TEDxSV talks came close to any of those (Sekou Andrews – watch it here starts at about 22min). Most of the talks seemed to be talking down to the audience, as in ‘you are lay people, let me preach to you’. Not inspiring, not like Itay Talgam describing how performances are about telling many stories, including the story of the audience (see Itay Talgam’s presentation at TED here). Most of the TEDxSV talks had only one story and it was about the presenter.

To bad, it could have been great, but perhaps this is what happens when you try to replicate something in multiple places.

]]>It seems, however, the Mozilla makes it as hard as possible to download previous versions. I never actually found the download for Thunderbird 2 and instead went looking for it in my ‘Downloads’ folder. I keep it for occasions such as this when people decide that old versions are not good for you….

Finally, since Lightning did not work with Thunderbird 3, I decided to use Sunbird (a standalone calendering app) to extract the Lighting data. Since I was doing this after installing TB3, I went hunting for the file containing my calendar data. Not only was this the most obscure file in the most unobvious place, but Sunbird was incapable of importing. Compounded with my basic problems with the buggy TB3, reverting back to TB2 was the thing to do. After I’d found my download backup, it was relatively easy to do, although the whole adventure cost me the better part of 2 hours.

On another note, I have huge amounts of stored email. It’s always been an issue, and it’s one of the reasons I use TB over Apple’s Mail.app. Mail.app just can’t handle large mailboxes (e.g. 3gigs 70k+ messages). Searching across all this is somewhat of a problem, however, and my solution was to run a local search engine on exported mbox files. However, I’ve found a better solution, MailStewart, a Mac-only application that will archive all your mail and attachments, index them and make the whole think searchable. It’s cheap and works great.

]]>There have been numerous attempts to hack fingerprints in particular, such as gelatin overlays, cutting off the actual persons fingers, etc., but it seems that the ultimate hack has now come about:

From http://news.bbc.co.uk/2/hi/asia-pacific/8400222.stm

A Chinese woman managed to enter Japan illegally by having plastic surgery to alter her fingerprints, thus fooling immigration controls, police claim.

Apparently, this is quite a widespread thing and it should really worry people. Not because of those bypassing the system, but because it’s only a matter of time before fingerprints are ‘cloned’ and innocent people are improperly accused/denied/arrested. It’s compounded by the fact that laws and law enforcement sees fingerprints as one of the stronger ‘proofs’ of someone’s presence in a particular place.

How long before fake irises or even DNA? Who knows, but it turns out that fingerprints are no more secure than any other form of identification.

]]>As a rule, VCs carry no debt, don’t use derivatives and don’t trade in the public markets. Since they had nothing to do with the credit meltdown, it remains a mystery why Treasury Secretary Timothy Geithner urged Congress to force them to register with the SEC as investment advisers, subject to staggering compliance burdens.Mr. Frank’s planned stay of regulatory execution will have a positive economic impact disproportionate to the small size of the VC industry. Venture-backed companies are responsible for supporting firms that now generate more than 20% of U.S. GDP and are needed more than ever to ignite a rebound in private-sector jobs.

From the Wall Street Journal

Hopefully this will lead to a revival of fortunes in VC land, although it’s probably false hope until the other end of the equation (SarbOx) is also dealt with…

]]>most legislation defines small business as companies with less than 50 employees. This stands in sharp contrast to the standard set by the Small Business Administration, which defines small business as manufacturing companies with less than 500 employees and nonmanufacturing firms with receipts of less than $7 million. The definition matters. Most plans in Congress set employer mandates at 50 employees or more, with no tax credits going to companies that are larger. Small businesses will have to offer the same levels of coverage as companies many times larger, and they’ll get no help to offset costs.

He concludes with some rather sobering thoughts about small businesses leading the recovery, or not, as the case may be:

]]>[M]y costs continue to skyrocket each year, with little hope increases will ever end. This puts me at a competitive disadvantage against foreign competitors with state-run systems.Last year our health-insurance bill jumped $140,000. We decided not to pass any of the increase on to employees since they were already being hammered by rising gasoline prices. We worried that bumping their costs up might force some good, well-trained employees to look elsewhere for work. But in order to cover that cost, we had to find either $2 million in new sales or the same in cost cuts. Otherwise, it came out of margin. I’ll give you one guess how we covered the hike.

Today I am no more hopeful, reform or not, that our company’s lot will change. I will still think twice about adding jobs when I know that I am not just taking on a new wage or salary, but high health-care costs as well. “How can you have a job recovery when you worry about such things”

]]>If there’s any question that this decision was bizarre, it should be dispelled by the fact that even most of the left (from the center-left to the far left) is puzzled by it:

http://www.salon.com/tech/htww/2009/10/09/a_premature_peace_prize/index.html

“If he achieves all [his goals], he definitely deserves a prize. But not quite yet.”

http://www.tnr.com/blog/obama-wins-nobel-peace-prize

“Seriously. Should he turn it down?”

http://www.dailykos.com/story/2009/10/9/791325/-Turn-it-down,-Obama

“He has to turn down the Nobel Peace Prize.”

http://www.thenation.com/blogs/notion/482445/the_aspirational_nobel

“These Nobel sentiments, however, are aspirational in my view. Obama doesn’t deserve the prize, yet. ”

http://www.talkingpointsmemo.com/archives/2009/10/unexpected_developments.php?ref=fpblg

“This is an odd award. You’d expect it to come later in Obama’s presidency and tied to some particular event or accomplishment.”

Of the 34 miscreants, two are pretty large, namely AIG and CIT, But the next on the list is First Bancorp, which received a mere $400 million from the TARP. Probably more important than the number is the trend, since the number of institutions that skipped dividends nearly doubled. In a supposedly improving economy and with a steep yield curve (at least until very recently), things appear to be getting worse rather than better.

Boy, if I missed an IRS payment, there would be some pretty big fallout, I’m sure. But with the banks, apparently nothing bad happens…..

]]>Wim Elfrink on Cisco’s Globalization Strategy. The metrics around growth and opportunity are particularly interesting. These kinds of global competitiveness measures are not often discussed in the US, even though a lot of people feel that they are there.

Very generically, the premise behind the strategy is that Western countries, and the US in particular, are mature, slow growth markets. Cisco believes that most of it’s future growth will come from both BRIC countries and other emerging economies. To that end, they plan to open ‘clone headquarters’ (my terminology) in a variety of emerging places, replicating all sales, marketing, R&D, production and HR locally. The idea is to better serve the local markets with products specifically designed and tailored for local conditions.

The first of these to be opened was the Bangalore center. A lot of people might say that this is just a huge cost cutting move, but I think it’s much more than that since, as Wim Elvink – Cisco’s Chief Globalization Officer puts it, labor rate arbitrage is just a temporary thing. Instead, he outlines the following key facts:

- 70% of the worlds population is within 5 hours flying of Bangalore

- Most of the future growth is in Asia

- Skilled labor needed by Cisco is more readily available in India

- Lack of legacy infrastructure means huge opportunities for Cisco

Cisco has already moved 20% of VPs to Bangalore and a lot of executive staff, so they are putting their dollars behind this strategy. I get the sense that it’s far too early to tell whether this is a success or not, although it has probably helped keep Cisco’s financials fairly healthy throughout the current financial crisis.

When I outlined a similar strategy for a client, it wasn’t nearly as radical. Instead, the idea was that merging economies, particularly Brazil and China, were deep into open source. That pervasive usage represents a huge opportunity to build out sophisticated new solutions that can be trialled in these countries and eventually brought back to the US. Skill set, labor availability (Brazil alone graduates 20,000 computer science students a year) and a willingness of local governments to fund and use open source based solutions all made this an interesting strategy.

Of course, there is a tremendous downside for Western countries if all the innovation shifts to emerging economies. But this is largely mitigated by the fact that most solution/product development is a lot of low-level integration grunt work. The highly creative work of innovating completely new ways of doing things still remains, even at Cisco, in the Western world. And, fundamentally, that’s really where the big money is.

–

Disclaimer: I am currently working on a project with Cisco, although it has nothing to do with this.

]]>For a number of years now, there has been a large amount of consolidation in the tech business. The goal of most of these consolidations has been to create vertically integrated companies that were capable of meeting the end-to-end needs of their customers. Novell had this idea years ago when it bought Cambridge Technology Partners, but the ball really got rolling when Compaq bought Digital, largely for it’s consulting business. More recent consolidation has seen HP buy EDS, but this has not been the only way vertical integration has been created. Microsoft followed the route of expanding it’s software offerings to the high-end, while IBM built a large services business.

The net-net of this has been the reversal of almost 30 years of broad horizontalization in the tech business. Vertical integration was the norm in the 1960′s and throughout much of the 1970′s. The introduction of PC’s and other technologies led to a layering approach where integrators could mix and match hardware, operating systems, middleware and other components, to build sophisticated combinations that solved business problem. The downside of this approach, at least for technology providers, was that most of the value was in integration, not components. “The people with the glue guns”, as Larry Ellison once derisively called integrators, were making more money than the component makers.

In response to this, large tech vendors started to build or purchase large professional services organizations to provide better integration and IBM was among the first to adopt this approach. Coupled with the rise of the internet and web browser as an application delivery platform, the momentum started to shift away from best of breed to pre-integrated component stacks on which applications could be built. Further abstraction and platform independence through interpreted languages like Java made it clear that real value was not in integration but in novel and unique solutions at the top level. The commoditization of lower parts of the stack by open source solutions like LAMP further accelerated the trend.

Having failed to make the transition, all of this left Sun largely without a growing market and largely adrift. Oracle’s purchase gives Sun the opportunity to be relevant again, this time as the foundation for a vertically integrated set of solutions around Oracle’s technologies. Coupled with innovations like Sun’s BlackBox datacenter in a container, it’s possible to see high-end, high-availability, enterprise scale solutions being delivered as appliances rather than the traditional piece parts. Indeed, Larry Ellison hinted at this this morning, saying that Oracle can finally deliver “a complete industry-in-a-box”.

For most enterprise customers, having witnessed vendor consolidation over the last 15 years, the Oracle/Sun combination creates a new, 3rd competitor (beyond IBM and HP) with a viable set of end to end solutions. Those happy with the glue gun approach will stick to large integrators like Accenture and Cap Gemini.

All-in-all, this is possibly a better outcome than IBM buying Sun.

P.S. I would note that Oracle is likely to focus on support as it has huge margins in this area. Funny enough, Dave Dargo, former VP of Open Source at Oracle, pretty much outlined a strategy around broad support of open source apps like mySQL years ago….

]]>- Do what ever it takes

- Focus

- Remember the Exit

I was describing recently to a friend of mine and it occurred to me that some of the lessons I have learned over years working with startups might apply in downturns. So here they are, 5 ways to survive downturns:

1. Do whatever it takes

It seems simple and trite to say “do whatever it takes”, but I am constantly amazed that people won’t do whatever it takes. Whatever it takes means literally whatever it takes, and it is hard to do. During Olliance’s early days, I was alternately working several part-time jobs or taking no salary in order to insure the survival of the company. Yes, it sucked, but it was doing whatever it took to get the company going.

2. Focus

Even in good times, lack of focus will kill a company. Several years ago, I was having lunch with the VP of Product Development for a global 100 tech company, discussing how lack of focus was killing some startups. His reaction was that the very same problem was endemic in his organization. Focus is absolutely critical to making anything deliver value within a reasonable timeframe.

3. Question every assumption

This is the flipside of doing whatever it takes. People make many assumptions about how companies are run and built, quite a few of which cost a lot of money. When I was VP of Engineering at a previous startup, we spent $15,000 on a PBX system. I always wondered whether that was a worthwhile expense. I’ve also encouraged companies to avoid having the overhead of office space, something which is less and less needed with modern communication systems.

4. Look for the opportunities

There is a silver lining in every storm cloud. It’s cliche, but it’s also true. A friend of mine is a VP at NetFlix and NetFlix is booming. It must be in his blood to choose counter-cyclical industries as his father owns a direct-mail business, which is also booming. And it’s not just in the US. I was talking to the CEO of Linagora, a French open source systems integrator, and his business has never been better.

5. Remember that there is no place to hide

In most downturns, there are geographies or industries that continue to do well. Not so in the current downturn. It’s an exercise in futility to look for them. The only solution is to face the downturn and do whatever it takes. Hunkering down is ok, but accepting that you will take a loss and moving forward is better. Figuring out how this mess makes your competitors weaker and taking advantage of that is even better.

Fundamentally, the current downturn is a result of a lot of things coming to a head simultaneously. Bunker mentality and fear, which I am seeing a lot of, are not rational or productive reactions. Instead, they are corrosive and destructive in every single way. The appropriate reaction is to accept the difficult situation and invest for the future recovery. In this economy, that is what the future winners are doing.

]]>If you step back and look at what has happened in the last dozen or so years, it’s been a remarkable ride. Not only have we invented whole new ways of communication, but these new technologies have wired us together in a way that no political, social, religious or economic movement has ever been able to do. It’s lead to whole new businesses, industries, jobs, fortunes and social trends.

In some ways, the turmoil of the last 6 months, and the impending inauguration of an African American President is the final, empathetic parting with tired traditional ways, a final rejection of an analog economy in favor of a digital one. Rick Schwartz, a pioneer in one of these new industries (domaining) recently wrote about this change in a ‘state of the domaining industry’ newsletter:

“We are going though unchartered territory and all comparisons with the Great Depression are misplaced but understandable. It was a different world then with much less opportunity and 1/100 of the tools at our disposal today. If you look at the headlines of 2008 you would find that 100 stories could vie for the biggest. Electing the first Black President, GM on the edge of bankruptcy, AIG bailout, Lehman Brothers, Merrill Lynch, Bear Stearns. Wachovia, WAMU, CITI. Madoff, Blago, Spitzer. Then add the stock market crash, housing crisis, credit crunch, pirates, Russian invasion of Georgia, wars in Iraq, Afghanistan, Gaza and tensions between Pakistan and India. Look what I left out. Israel, Iran, China, North Korea. See how hard it is to mention one thing without taking the time and space to mention the other things? You folks can add dozens more. Any one of these events in a normal time would be huge. Together and all at once is really something hard to get your head around.

There is a difference between a downturn and a collapse. The difference between a plane descending and one in a tailspin and completely out of control. We are witnessing both at once. Then add in massive layoffs, corruption, no confidence and a world in an informational transition between two era’s and we have what may become the perfect storm. You cannot sugar coat what we are about to experience. Usually things like this are contained to a geographic area or region or a sector. This is worldwide. This is hitting every corner of the globe. This is something we have really never seen before. We are living in a very vivid part of history.

…

For literally hundreds of years we have been getting our news in printed form. Much of that time in newsprint. The newspaper has defined generations. Tracked history on a daily or weekly basis for generation after generation after generation. In 2008 that method of delivery all but collapsed. Collapsed like a cheap card board box. One of the single oldest mediums met its’ fate. Some are still printing yesterday’s news and that will continue for years, but less and less people are buying yesterdays news nor are they advertising there using yesterdays news as a base. Folks get news all day. They can filter out what they don’t want and filter in what they do. Other mediums are not immune. The Internet has displaced the entire economics of the world which was greatly accelerated by everything that went on for the last few years.”

Brilliant. The fall of the newspaper as symbolic of a generational and technological transition. I think that his wider perspective is extremely prescient and something that everyone should keep in mind. Of course, the flip side of being part of history is that there are always opportunities. Which brings me back to ‘World at War’, the epic story of World War II. The series starts off rather gloomy and without much hope, but as Allied powers slowly fight back and gain ground, they begin to see the light at the end of the tunnel.

At the moment, much like in any crisis, there seems to be little hope, but I firmly believe that the moment in history that the current crisis is creating will lead to a new ‘Greatest Generation’, on that used the new tools of technology to build a better, sustainable future.

Chris Maresca is a business & technology strategist who as advised over 30 global 500′s and over 60 startup companies. In 2001, he founded the Olliance Group where he is currently Chief Strategist. He can be found on the web at http://www.chrismaresca.com ]]>

Of course, open source in the US government is nothing new. Almost 15 years ago, I build a bunch of systems on Linux, Apache and other open source projects. One of the first things I worked on was a e-commerce site for the US Travel and Tourism Administration. Interestingly enough, it used to be that you could order publications and run queries on live data on the website, functionality which seems to no longer exist…. A footnote is that the LAP (no M, I think we used BerkeleyDB) machine we built ran for 2 years after we stopped maintaining it, only to be taken offline because someone cut the power.

Other projects involving Linux, Apache and mostly Perl included an inventory control system for the National Institutes of Health, the first intranet of the Department of Health and Human Services, data processing and aggregation for the Head Start program and a unified email system for the Department of Commerce (70,000 employees, 1500 agencies across 130 countries…). My partners in crime in all this were Peter Hartzler and Jim Devaty, we were all working for a small government contractor called Ellsworth Associates.

At the time (1995), when we built systems for various agencies, we would not tell clients that we were using open source, but rather used generic terms like Unix. Both open source and the internet were quite exotic and we had problems sourcing robust enough software, either in open source or running on Linux, and explaining how we were building systems. One classic example of this was our need for a more robust database. We started with Empress, then tried Solid. We eventually settled on Oracle, using Linux’s ability to run SCO binaries. When we called Oracle for a license, they asked how many end-users we had. Since the data was to be published on the internet, we told them ‘millions’. You can see where this went, particularly since the Oracle sales team had never heard of the internet….

I eventually left government contracting for the craziness of the dot com boom in Silicon Valley, but that was not to be the end of my exposure to open source in government. One of the first contracts my new company got in 2001 was to look at the use of open in a naval command, NAVOCEANO. Our findings were widely published and we concluded that open source had very high ROI in the kind of deployments this particular organization had. In the following years, with huge budget pressures on non-warfighting commands, this advice and strategy proved to be invaluable for NAVOCEANO and eventually resulted in Navy-wide strategies around open source.

But it wasn’t just the US government that was interested in open source. As part of a wider project in the UK, we spent time with Minister for E-government Transformation of the UK Cabinet Office. The UK government was embarking on a wholesale restructuring of government in an attempt to reduce redundant departments. Part of this was to be achieved by building extensive web-services framework, whose maintenance would be outsourced to an SI. The fear was that, essentially, the government would create an external department over which they would have little control or ownership. And the question was, could open source mitigate this potential problem? This question resulted in some interesting discussions to say the least…

But this was not the last time we would help government leadership use open source for policy aims. One project we worked on was developing an open source strategy for four cabinet-level US government agencies around a specific piece of software. The Department of Housing and Urban Development (HUD) had build a very sophisticated enterprise architecture and management software that had subsequently been deployed at Justice, Agriculture and Labor, and the GAO was considering as a standard application across all agencies. The problem was that HUD alone was responsible for it’s development and it could not solicit funds from other agencies to support the development efforts (congressional budgeting rules forbid inter-agency funds transfer with congressional approval). So the CIO at these agencies wanted to see if they could fund an open source project that they all could contribute to. In the end, going it alone proved to be too expensive and politically risky, but the problem was solved when one of the main developers setup his own OSS project.

Open source in government has evolved in fits and starts, but it’s potential benefits are enormous. In large parts of the world, from France to Brazil, it was seen as a way of distancing governments from the hegemony of American software companies, but in other place like the UK and US, it has been seen as a way of strengthening government control over it’s institutions.

In either case, it’s interesting that it has finally come full circle after 15 years. Back in 1995, not only did we build production systems using open source, but we also were active participants in the open source community. Looking back on it, I guess you could call us pioneering, even if we didn’t see it that way, it was just a better mouse trap. We don’t do much work with governments anymore, as it seems that open source has become more of a political that a strategy issue, but perhaps that will change in the coming years.

Chris Maresca is a business & technology strategist who, over the last 15 years, as advised over 30 global 500′s and over 60 startup companies. He can be found on the web at http://www.chrismaresca.com ]]>

One would think that the solution would be to measure this lag, but it’s actually much more complicated than that. Part of the motion problem is that the lag is highly dependent on various environmental factors, such as load or amount of wear in the system. In order to deal with all these problems, motion control engineers have developed something called PID feedback.

Basically, PID feedback uses a position sensor to figure out what the current position of the system and what the next command should be. It looks typically like this, if you imagine it as a conversation:

- Move to position

- Acceleration to ‘cruising speed’

- Where are you?

- Not there yet

- Where are you?

- Close

- Deceleration

- Where are you?

- Passed position

- Go back to position

- Reverse

- Where are you?

- Before position

- Go back to position

- (etc)

What is clear from this sequence is that the system winds up in a forwards-backwards oscillation. Motion systems deal with this through precision and dampening. In practice, there is almost always oscillation, its virtually impossible to get rid of, at least in motion PID systems. Wikipedia has a great article about PID feedback and control.

So, what does have this have to do with markets?

Well, in the last few months, I’ve paid much closer attention to financial markets that I usually do. Part of this was because there have been some real stock bargains, but also because I was curious about what is a really bad market. One of the interesting things I noticed was that markets seem to behave much like PID controlled motion systems. If you look at the daily down ups and downs, they look an awful lot like oscillations in a PID system.

y theory is that the current speed of information is much like computers commanding motion systems to a position, but markets are like physical systems, so they take time to react and move to the ‘position’. Basically, you have digital system (modern high-speed, universal, virtually instantaneous information delivery) trying to control an analog system (markets and the humans behind them).

Of course, none of this is a predictor or gives any sort of insight into when the oscillations in the market will end. It’s just an interesting thing I noticed.

Chris Maresca is a business & technology strategist who as advised over 30 global 500′s and over 60 startup companies. In 2001, he founded the Olliance Group where he is currently Chief Strategist. He can be found on the web at http://www.chrismaresca.com ]]>

People are paying the US government to take their money.

Usually, it’s the reverse. The US and other governments need to pay interest on money they borrow from people, usually at a rate higher than inflation. Rates are usually priced so that they are sure to sell, but, in this economic climate, they are essentially priced at zero, less than zero if you take inflation into account. Having the yield go negative, however, means a lot more than being priced at zero.

Yields go up and down over time as bonds are traded on markets. A negative yield, which had never happened before, basically means that people are more interested in a safe place to park money than on any return. Fair enough. But there is another strange side effect to this. Bonds, and their market values, also reflect relative trust in an institutions future viability. Viewed in that way, bond markets are saying that they have full confidence in the future of the US government, and, by extension, the United States.

So much so that they are willing to pay us to spend money.

Think about that notion. The United States, like most governments, has two basic ways of meeting budgetary obligations: taxes and currency inflation. Taxes are obvious, and government debt is used to fill the gap between current expenditures and future revenues. But currency inflation (eg. printing lots of money) is virtually unknown in the US, partially because our currency management institution (the Federal Reserve) is independent from the government. Generally, currency inflation is really bad, it typically leads to things like Zimbabwe’s 8 quintillion inflation rate. However, if people are paying you to take their money, well…. maybe currency inflation is not so bad. You could actually profit from it, in theory.

Which makes for an interesting conundrum. It would be possible, give all this, to have both deficit spending and tax cuts without a hugely negative impact. And what if the US government refinanced all future debt under these terms? What would that do to underfunded future obligations and the current deficit? And where does it leave traditional political arguments from both the left and right?

Who knows? But, we sure do live in interesting times.

]]>1. Software development as an act of alchemy

Making software has always been a complicated thing, somewhere between engineering and art. Software developers, while outwardly pretending to be engineers, are much closer to music composers and what they produce is, much like music, rather nebulous and intangible in quality. Steve Jobs famously said that great software was “indistinguishable from magic”, ergo something much akin to alchemy or some other opaque creative venture (like music).

The flip side of this is that most software development sucks, both for the developer and for the user. It’s often late, over budget, only does 30% of what you want and 10% of what you need, and constantly breaks. And, like music, you know crappy software when you see it, but it’s often hard to describe generically why software is crappy.

There are lots of reasons why software development turns out this way, but one of the major factors is lack of transparency in the development process, particularly for users. Open Source software development processes turn all this on it’s head and the result is generally better software, even if it has fewer features. The magic that enables this to happen is the community that is built around the software. The larger it is, the better the software will likely be and the more aligned it will be to it’s users needs.

2. Building blocks vs solutions

When software developers talk about software, they will mention things like Linux, mySQL, Oracle, PHP, etc., but none of these applications are actually relevant to businesses and business problems. They are largely building blocks, bricks if you will. Out of these, one can build solutions to real business problems, but on their own, they are useless.

Misunderstanding this dichotomy is a common mistake made by businesses of all sizes and not just in Open Source. A building block/technology is only a component of a large solution. Sure, you can sell building blocks, but when everyone has similar building blocks, they become commodities, like bricks. And commodity products, whether bricks or software, have low margins. However, even with commodity products it is possible to drive higher margins by creating value-added components that differentiate your commodity from others. Even then, if you are in the commodity business, it would be wise to optimize your business structure for lower margins. Because, in the long run, the high value is in producing solutions to business problems, not building blocks.

This has always been the issue in the software business, since market maturity dictates more vertically focused solutions rather than broad, horizontal solutions. In the end, only a small number of large organizations wind up dominating the commodity space. The same sort of dynamics are beginning to emerge in the Open Source space with a few large projects dominating various broad horizontals (Linux, Apache, for example), even if they do not revolve around commercial organizations.

3. Commoditization as run to the bottom

One of the points that is often made about Open Source is that it drives the price point to zero. This is essentially the same argument that people make about Walmart and its constant drive to lower prices. In Open Source, this is only partially true, as the ‘free’ nature of the software is deceiving. Someone has ‘paid’, in some fashion, for any Open Source software development, often by providing a resource to do something (coding, testing, community participation, etc). The net effect is a software product that, while free, represents the shared interests, needs and contributions of a community.

This shared development results in a lower overall software costs for certain key building block pieces, enabling organizations to spend more money on software which solves actual business problems. For software developers, it means no longer replicating generic infrastructure in each project, but having access to a wide set of building blocks and being able to tap into the collective knowledge of global communities. Cheaper, faster, more focused software solutions with lots of code reuse. Isn’t that what everyone has been after for decades?

The other interesting dynamic is that once products have reached the ‘bottom’ of the commodity curve, then there is generally a flight to quality. Even the CEO of Walmart, Lee Scott, has acknowledged this dynamic by suggesting that Walmart’s future strategy would be to focus on higher quality goods with a longer lifetime. In this dynamic, the best software will win and Open Source will be highly competitive. Not because of cost, but because of user involvement in the development process, it is the closest aligned with user needs.

So, what has Open Source done for the software business?

Well, it’s created whole new communities of energized users & developers and pushed them to collaborate on better and better building blocks. Those building blocks, because of their low cost, focus and quality, have enabled a whole new series of business models, from Google to SaaS to better professional services margins. And let’s not forget that it’s on Open Source that most of the internet is built. The net effect has been nothing short of the a revolution in software, and, finally, the hope that software will cease to be a black box and will actually meet the needs of it’s users.

Certainly, being successful in this highly competitive environment is not easy or simple. But it is possible, and for those who can think beyond the traditional software licensing models, there is wealth of opportunity. For business leaders in the Open Source space, I would highly suggest reading Mike Masnick (of TechDirt) treatise on the Economics of Free. While his focus has largely been around the entertainment industry, there are interesting ideas in his thinking that could be applied to Open Source as well.

]]>I’ve seen this first hand in work I did for the US Navy. As budgets were increasingly re-directed to warfighting, critical but non-combat systems were increasingly developed with Open Source technology as a way to alleviate the funding gap. In one case I know of, a portable system budgeted at 20 units doubled it’s deployed units by switching to an Open Source architecture. That and other successes allowed more widespread acceptance of Open Source, with resulting wider adoption. That said, in the last downturn, I also saw a lot of executives use the threat of Open Source use as leverage in contract negotiations with proprietary vendors. In actual fact, they probably would have never deployed any Open Source….

It’s also true that a lot of innovation and new companies starts in downturns. I’m seeing this all around Silicon Valley with a lot more people starting companies that even 10 months ago, even if a lot of VCs are nervous about their LPs pulling out. And this dynamic benefits Open Source projects as people find themselves with more free time or need to update their skills.

However, none of this is really revolutionary, we’ve seen it happen before. Now, however, there are a bunch of new companies hoping to benefit from these trends, both as consumers of Open Source and as businesses built around Open Source. The problem right now is that financial panic has lead to a widespread bunker mentality at all levels of business and it’s making it hard for anyone to make a sale, never mind just getting calls returned.

Open Source-centric companies are no different, but where they do hold an advantage is in their ability to get adoption without a PO. Technology users still have business problems to solve, even if they have no budget and that is good for Open Source. When everyone finally emerges from their bunkers and decides that they need support, maintenance, additional functionality, professional services, whatever; Open Source and it’s supporting companies will be there to assist.

]]>Of course, since I’m a technologist, I just had to understand how these things work. The quartz ones are pretty obvious, although there is still a surprising amount of analogue, mechanical technology in even the most modern quartz watches. Electrically driven watches were actually pioneered by two American companies, Hamilton and Bulova. Pure digital watches (with numeric displays) were developed by Hamilton in the early 1970′s and lead to the digital quartz revolution (which is a fascinating story in itself, but for another time). Up until this time, watches were expensive jewelery that one bought perhaps a 1/2 dozen times in your life. But, as a result of mass manufacturing techniques pioneered by the semiconductor industry, companies like TI and Casio were able to crank out millions of cheap LCD watches that anyone could buy.

These innovations almost killed off mechanical watch manufacturing, particularly in Switzerland. And it did kill it off in the US, as there was no demand for essentially hand assembled, fragile and inaccurate mechanical jewelery. However, some manufacturers managed to survive through the 1980′s and emerged in the early 1990′s as objects of desire, cool symbols of a bygone age of hand made items. Of course, marketing helped a lot. Today, we even find a few new American watch manufacturers, like Ocean7, Bathys and the Rocky Mountain Watch Company.

So, what’s the point of all this? Well, in my watch explorations, I bought a couple of interesting vintage watches that illustrate key transitions in the watch industry. One of the fascinating things is examining how different cultures solve the same problem. I was taking apart some mechanical watch movements (both broken and worthless), one Swiss and one American, both of roughly the same vintage and from products aimed at the same market segments. Below is a photo of the spring bar that provides the ‘click’ when you pull the crown out to set the time or date.

The fascinating thing is how each manufacturer chose to solve the problem. On the left, the Swiss created a beautifully machined precision part. On the right, the American created a crude stamped part. Which was more effective? Well, keep in mind these watches sold to the same market, so the price was likely comparable. The Swiss watch might have retailed for more, but the American manufacturer was almost certainly more profitable. In the end, the precision part shows a reluctance to give up on a key cultural trait to improve margins.

That is why so many Swiss manufacturers went bust during the quartz heyday, but it is also why their products are so in demand currently. Even the new American manufacturers use Swiss movements. Just goes to show that, sometimes, if you can stick it out long enough, the market may value your contributions once again.

Oh, and, BTW, the ‘curtain rod’ on the left is a 1mm stainless steel bar….

* in case you are wondering, most of my purchases where either vintage or cheap, I can’t see justifying over $200 on something I am likely to break…

]]>- “The media are making all kinds of noise lately to the effect that electric cars are coming, that they’re going to help us kick our imported-oil habit, and that you’ll be able to drive them for pennies a day.

A company that can develop a non-petroleum-fueled car palatable to the masses stands to make a pretty good buck. That’s why GM will shell out some undisclosed number of billions on electric vehicle development during the next five or so years.”

Sounds about right and probably true too, nothing all that revolutionary about any of this. This is precisely what, in addition to GM, Tesla and Fisker are trying to do. Let’s read on:

- “It’s a tall order, but GM is already well on the way to pulling it off. Whether the buyers will be there, however, is a question GM is still struggling to answer.

A study commissioned by Gulf & Western predicts that we’ll have something like 34 million EVs – about one quarter of the national fleet – on the road by the year 2000. GM … has publicly committed itself to mass-producing electric cars by the mid-to-late 1980s – probably 100,000 per year or more.”

Wait. What? Actually, the Car and Driver issue I was reading was dated June 1981.

Fascinating.

Fast forward 27 years later, more than a quarter century, and the meme is once again in the air: electric cars are the future.

Are they really? Even in 1981, just after a period where the US almost ground to a halt due to lack of oil, there was some skepticism about relying on electricity:

- “In fact, compared to gasoline, electricity is a downright ludicrous power source for cars. In terms of volume, it takes 350 liters of lead-acid batteries to match the energy in one liter of gasoline.”

While we no longer rely on lead-acid batteries for portable power (can you imagine one of those in your laptop?), the fact remains that gasoline and diesel are some of the densest forms of power ever discovered. Electricity is not nearly as portable or dense.

And this may be at the core of the problem for all electric vehicles for some time to come, even if it is just a talking point for most people. This is because the average person drives daily average distances well within the range of a Tesla or any of the proposed EVs.

Still, Americans like their freedom, and part of that is freedom to roam, without a tether (e.g. limited range, 4 hour recharge). In that sense, nothing has changed in a quarter century.

In fact, not much has changed in the last 18 years. You see, 18 years ago, VW showcased their new hybrid technology at the 1990 Geneva Motor Show. It was to be available in every VW model in the next 2 years.

There are a lot of things that can be learned by reading the state of the early ‘80s electric vehicle market and from VW’s hybrid introductions from the early ‘90s, but one important potential lesson is that oil prices are volatile and cyclical.

Alternative energy gets great boosts when energy markets go haywire and mostly falls down spectacularly when markets calm down, often taking billions in R&D with it.

The companies and technologies that do survive are the ones that are sustained through the troughs, either by prescient companies or by smart government support. In the United States, both of these are in rare supply. This goes a long way to explaining why GM is not a significant player in the ‘green’ vehicle market, and why 20% of our electricity is from hydrocarbons and 46% from coal.

Perhaps it’s time to think about energy technologies on a slightly longer timeline than quarterly results and presidential election cycles. If we don’t, in 2030, we’ll be looking back on 2008 like we are now looking back on 1981.

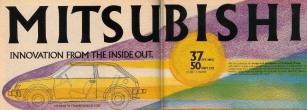

NB: Just more of a poke in the eye from 1981… Smack in the  middle of the electric vehicle special is an ad for the 1981 Mitsubishi/Dodge Colt, EPA est. fuel mileage 37 city, 50 highway. 30 years of technology improvement and we’ve gone backwards. Even a Prius is not that fuel efficient.

middle of the electric vehicle special is an ad for the 1981 Mitsubishi/Dodge Colt, EPA est. fuel mileage 37 city, 50 highway. 30 years of technology improvement and we’ve gone backwards. Even a Prius is not that fuel efficient.

MetroFi’s plan was to subsidize free WiFi with ads and offer a faster, premium ad-free service for a fee. Apparently, they were not able to make this work economically, despite the fact that a whole lot of places were looking to roll out muni WiFi. One wonders if these wide-area, ad supported networks will actually work since there have been a bunch of failures with this business model in the last few months. Even here in San Francisco, which is attempting to roll out a muni WiFi network with the help of Earthlink and Google, not much has happened.